FOR LOCAL AND INTERNATIONAL MULTI-PURPOSE CO-OPERATIVE SOCIETY (…God’s foundation is the best)

AND

CREDIT

SOCIETY LIMITED

REG NO: 18459

BYE LAWS OF THE COOPERATIVE THRIFT AND CREDIT SOCIETY LIMITED

Make sure you go through this bye law thoroughly before you can become a member of the society.

You have to pass through stages:

Our cooperative society is to cultivate a savings culture in individual member’s life. It is an age-long established fact that nobody can escape poverty without a savings habit. Anybody that spends everything on consumption is just a step away from poverty and its various consequence, no matter how rich the person is today. The story of the prodigal son is instructive in this regard. No matter how much a man earns a percentage of it should be kept aside as savings.

The requirement of being a member is

1. Obtaining of membership form with little amount stipulated by the society.

2. purchase of document with (3) passport photograph including identity card.

3. Introduction of rules and regulation of the society.

Our society is an autonomous and duly registered association, with a common bond of interest, which is voluntarily joined together to achieve social, economic, and cultural needs and aspirations, making equitable contributions to the capital required.

C-Capitalized by Members with common goal

O-Owned by Members

O-Operated by Members P-Patronized by Members

P-Patronized by Members

4. Applications for loans and procedures of obtaining loan

- Bought a form with speculated money from the society

- Fill it with guarantor and one external

- All applications for loans shall be made to the member.

- The member shall put in place necessary procedures for the processing, review, and approval of loans.

- Appropriate channels have been established for the control and disbursement of loans within a reasonable time frame.

Loans to Members

- No loan shall be granted to a Member earlier than 6 months of becoming a financial member of the Society.

- Any member who default shall entitle to fine of

N1000 weekly or he/she can bring it together with the next payment.

Security for Loans

The members shall from time to time determine the maximum credit limit of each applicant for a loan

The credit limit shall be subject to the availability of funds, the principle of making credit available to as many Members as are qualified and the securities offered.

Self-guarantee shall be required of Members who are taking equal to or less than his/her net saving balance.

The savings account balance constitutes the first collateral and basis for determining for loan to be taken by members. Guarantor(s) are required from borrowers as the need arises to collateralize loans that may be granted to eligible Members.

Duties of Guarantor

A guarantor must be an active member of the society and shall personally be responsible for:

- Repayment of the loan if the borrower defaults.

- Authentication of the particulars and details provide by the borrower(s).

- Must monitor how the applicant is repaying the loan.

| Tenor (months) | Interest rate | |

| Normal loan | 06 | 2% |

| Special loan | 08 | 2.5% |

| Short term loan | 03 | 1% |

| Short term loan | 02 | 0.8% |

| Short term loan | 01 | 0.5% |

| Commodity loan | 10 | 5% |

| Investment loan | 08 | 5% |

5. Developmental levies shall be paid twice in a year as speculated.

6. Any expenses shall be withdrawn from the passbook not by cash.

Benefits of COOP Savings

- Plan for targeted expenses, reduce or eliminate unnecessary expenses.

- Plan for future goals. i.e education, training, traveling etc.

- Plan for emergencies

- Investment Planning

- Sharing of Dividend to the members at the beginning of every year

Non-payment of Savings

- A member who refuses to make savings for a consecutive period of 6 months shall have his/her passbook dormant and technically suspended.

- Where membership is suspended for reason of refusal to make weekly savings, such member shall not exercise his/her membership rights as enshrined in the Byelaws unless the passbook is reactivated

- A member whose membership is suspended for reason of refusal to make savings can have his/her passbook reactivated and rights restored upon payment of savings for at least six (6) consecutive months.

- The member who refuse to make savings is entitle to fine of

N200 weekly.

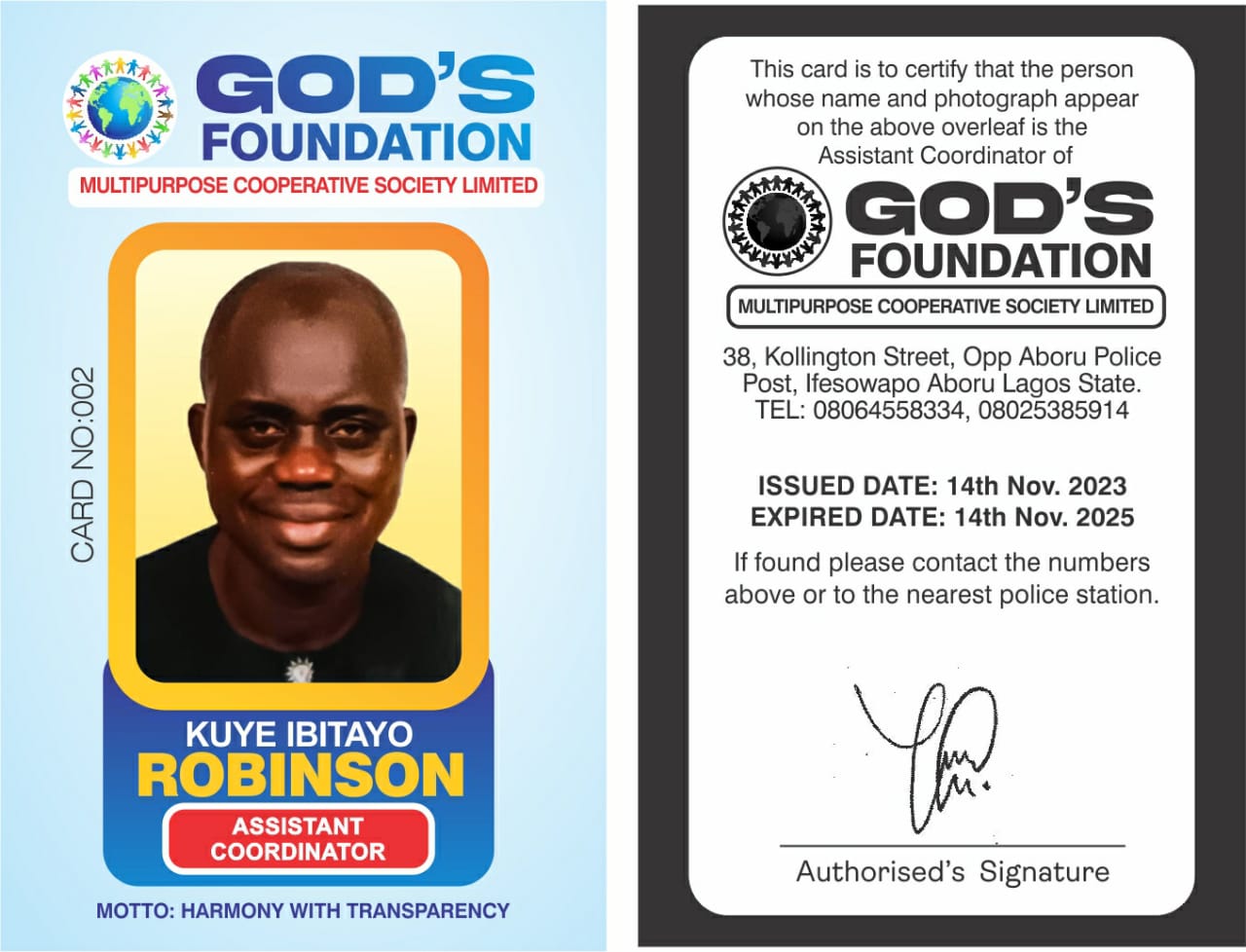

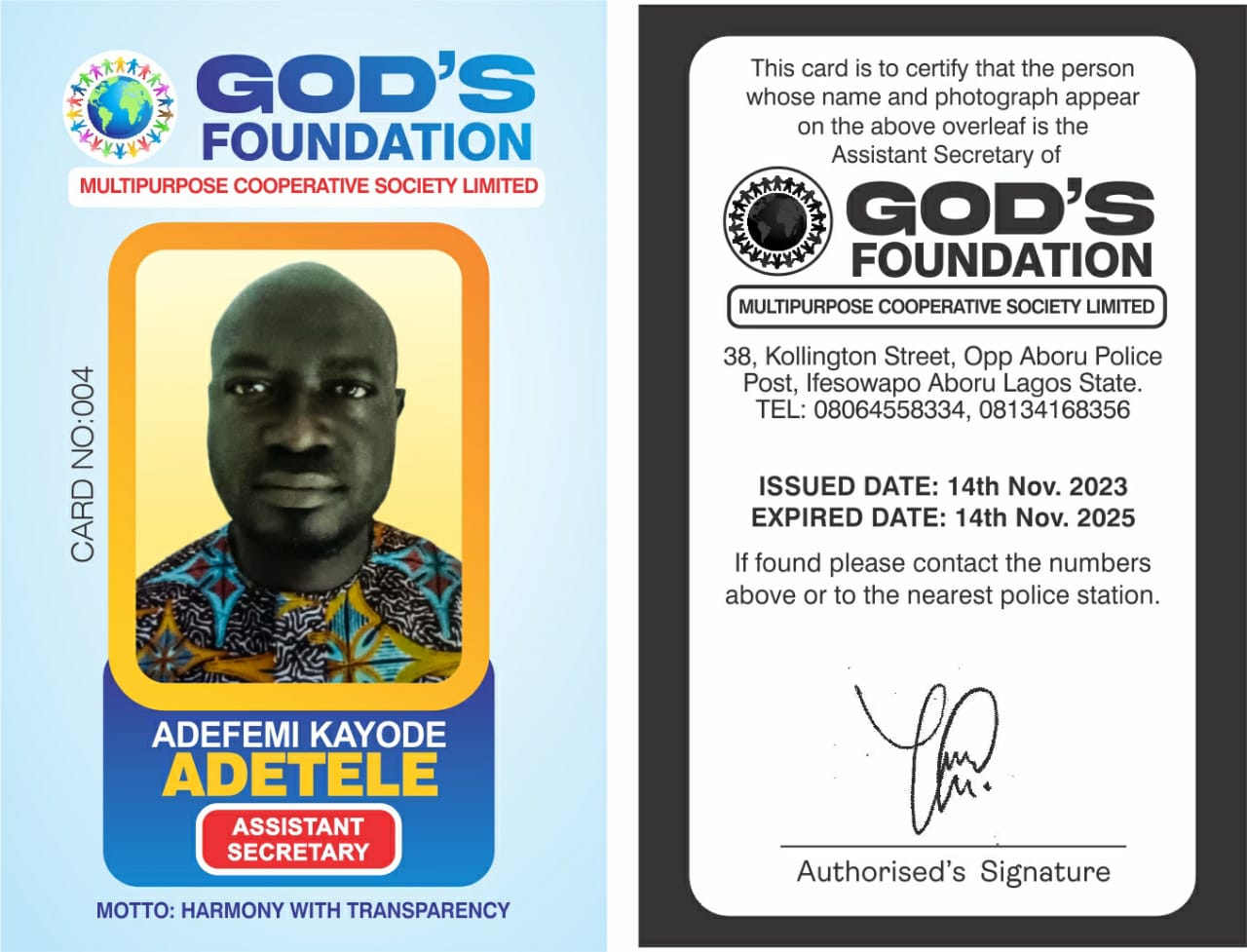

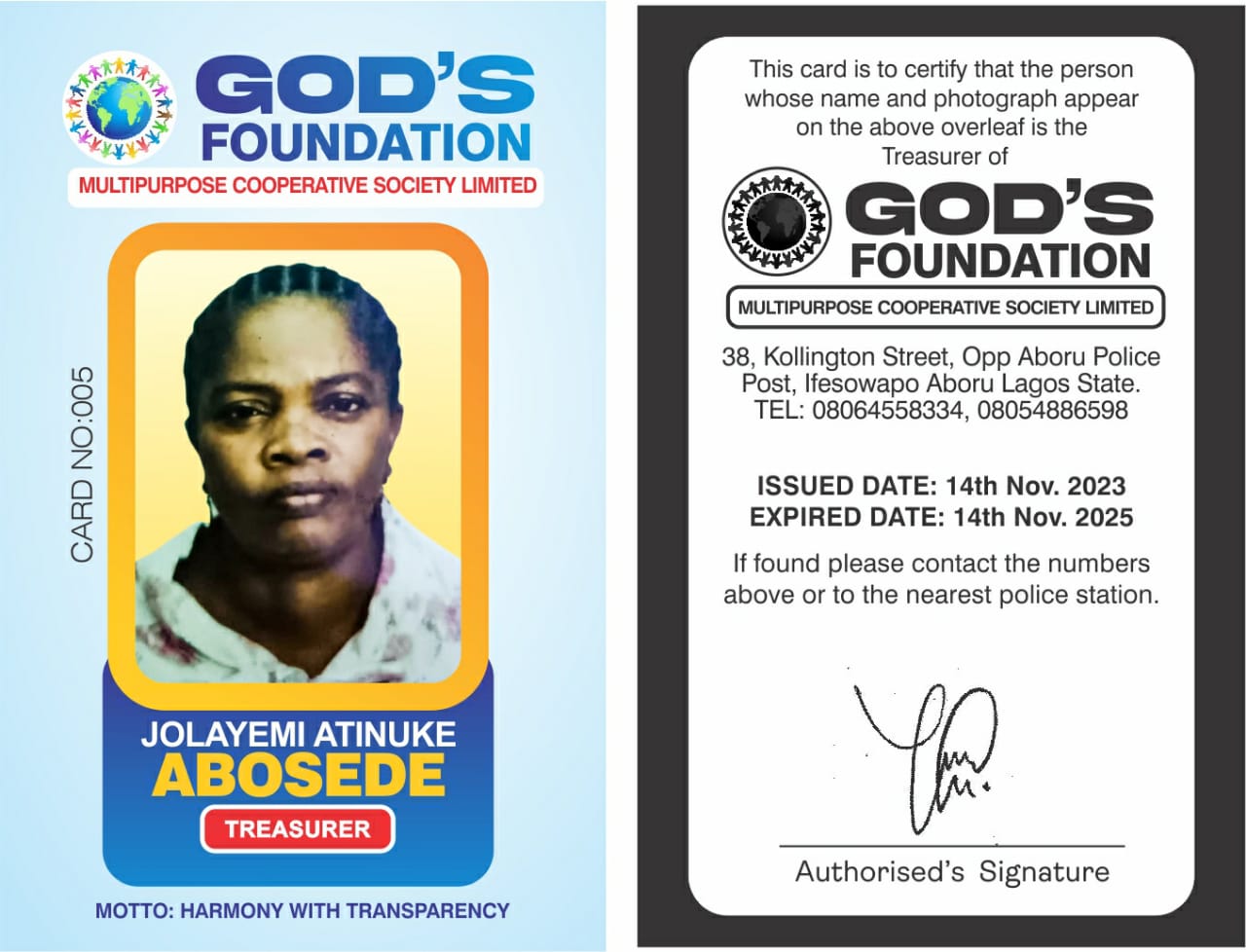

COMMITTEES/EXECUTIVES

To facilitate the effectiveness of the Board of Directors in fulfilling their responsibilities and to assist the Chief Executive Officer (CEO) in his/her administrative duties, directors are appointed to the following committees by the president of the Board of Directors.

DUTIES OF EXCOS AND AREA OF CONCENTRATION

Standing Committees

Made up of directors who serve on the respective committees throughout the year?

Executive consist of: President (Chairman), Vice-president, Secretary, Treasurer

Duties:

- Shall act for the Board of Directors in emergency situations when the full Board cannot be convened. The Compactification of its action as soon as possible.

- Shall act as liaison between the Board and CEO on all matters.

Budget & Finance Committee

Secretary and Treasurer (chairman), and at least two other members of the Board.

Duties:

- Shall assist the CEO in preparing the annual budget, and to recommend action to the Board.

- Shall serve as the Cooperative’s Audit Committee.

- Shall recommend to the policy Committee any policies relating to the financial requirements of the Cooperative.

Labor Committee

Vice president (chairman), and at least two other members of the Board.

Duties:

- Shall assist CEO on all personnel problems and recommend appropriate action to the Board.

- Shall review employee wages and benefits annually, and recommend appropriate action to the Board of Directors.

- Shall perform conflicts of interest review annually.

- Shall recommend to the policy committee any policies relating to personnel matters

Byelaw & policy committee

A chairman and at least two other members of the board.

Duties

- Shall review all policies annually.

- Shall see that any new policies or policy changes are accurately reflected in the policy manual

- Shall see that the directors and employees (if affected) receive copies of all new and changed policies.

- Shall review all board minutes annually.

- Shall review byelaws annually.

Community Engagement Committee

A chairman and at least two other members of the board.

Duties:

- Shall carry out the objectives of communication reflected in the policy manual, as well as being responsible for the overall public affairs of the cooperative.

- Development and ongoing coordination of a calendar of events

- Development and ongoing coordination of a public communications plan as outlined in policy manual.

- Shall meet at least quarterly and additionally as needed.

Special Committees

Made up of directors and other members to serve for a specific purpose on a limited, as needed basis.

Withdrawal of Savings

- No member can withdraw the whole of his regular savings except upon withdrawal of membership after giving a minimum of eight (8) months’ notice to the society.

- Savings withdrawal shall be allowed at a maximum of 10% of savings balance, provided the member have no loan running at the time of withdrawal and have saved continuously for a minimum of six (6) calendar months.

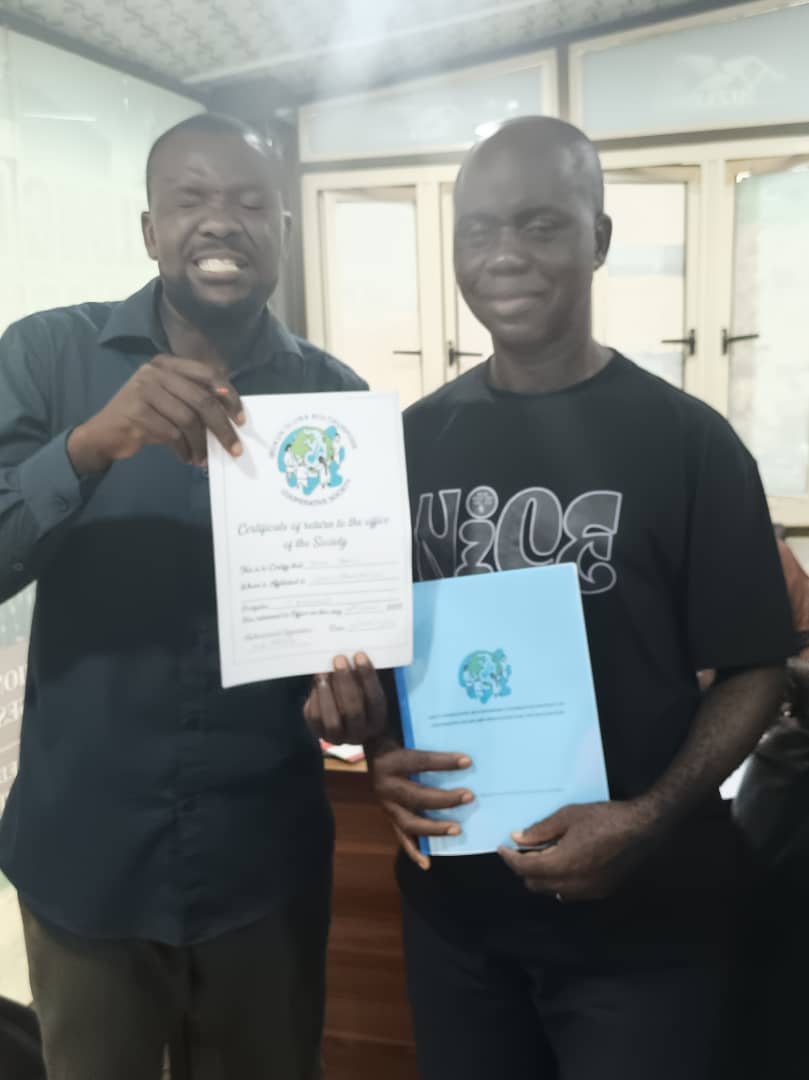

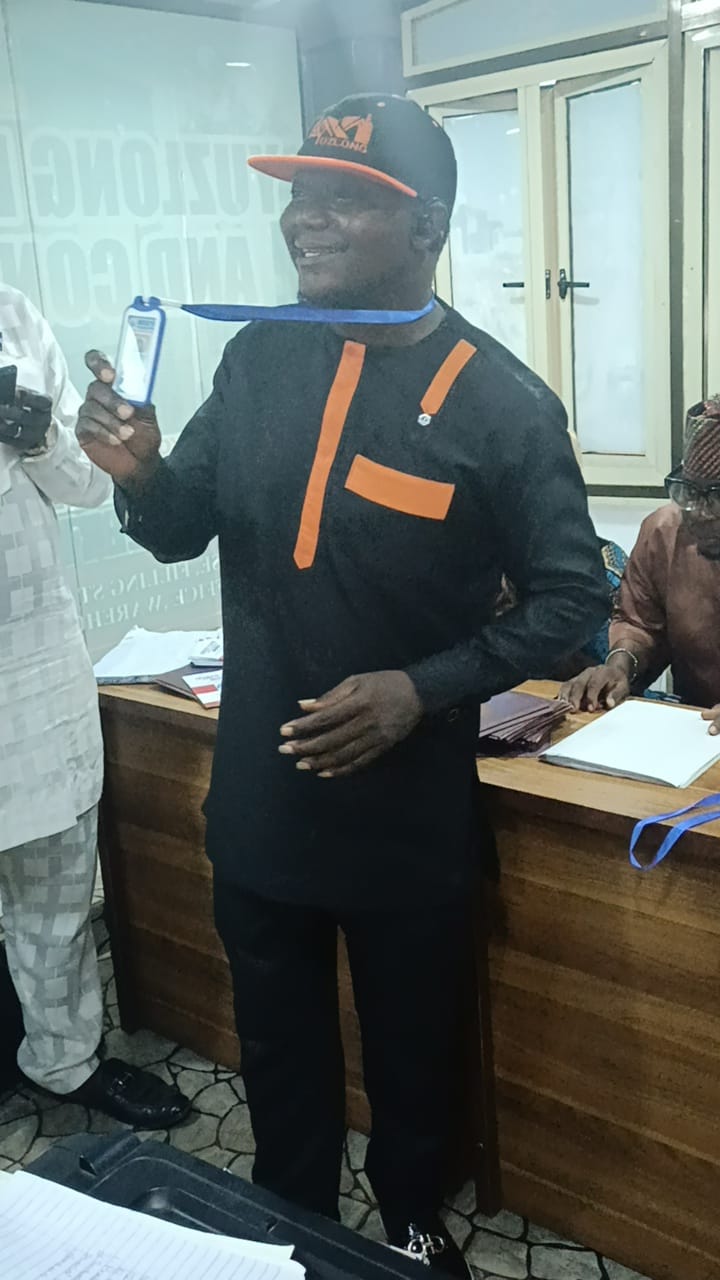

INAUGURATION CEREMONY